Emerging economies are not taking the European demands for control of the IMF laying down. They are not buying the “only a European can solve this” rationalizing and are pointing out the contradictory statements made by officials just a few years ago.

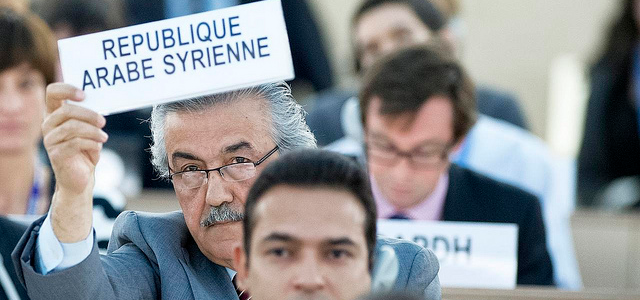

In a statement released yesterday, the IMF Executive Directors representing Brazil, Russia, India, China and South Africa – with a combined 15% of the voting shares – contrasted Jean-Claude Junker’s comments last week that the Euro crisis demanded an European head the IMF with his comments in 2007.

In a statement released yesterday, the IMF Executive Directors representing Brazil, Russia, India, China and South Africa – with a combined 15% of the voting shares – contrasted Jean-Claude Junker’s comments last week that the Euro crisis demanded an European head the IMF with his comments in 2007.

These statements contradict public announcements made in 2007, at the time of the selection of Mr. Strauss-Kahn, when Mr. Jean-Claude Junker, president of the Euro group, declared that “the next managing director will certainly not be a European” and that “in the Euro group and among EU finance ministers, everyone is aware that Strauss-Kahn will probably be the last European to become director of the IMF in the foreseeable future”.

Agustin Carstens, Mexico’s central bank governor and candidate for the IMF post, challenged the view that the current euro crisis was sufficient reason for requiring a European head.

“I don’t see why,” Carstens said, “to contribute to solving the crisis in Europe, a European has to be the managing director.” The fund can help Greece, Portugal and Ireland make “tough decisions” about their debt, though the next managing director will have to focus on economic concerns beyond Europe, he said.

“Right now the crisis is in Europe, but we don’t know where the next crisis will be,” said Carstens, who oversaw 80 countries while IMF deputy managing director from 2003 to 2006.

Moises Naim, a former executive director at the World Bank, takes down the argument brilliantly in his Washington Post column this morning.

Influential European columnists such as Martin Wolf and Wolfgang Munchau have argued in the Financial Times that given the IMF’s critical role in the rescue of the continent’s troubled economies, only someone with vast political contacts in the region can operate effectively there. “Certainly, no non-European could play the role Mr. Strauss-Kahn did in the eurozone,” Wolf writes. Or as Munchau puts it, “I wonder to what extent a highly competent Mexican central banker, for example, would be able to fulfill this role?”

Funny how such consideration never seemed to come up when Asia and Latin America had their own financial crises in the 1990s. Somehow, it didn’t much matter then that the IMF was run by a Frenchman or a German lacking extensive political contacts in those regions.

Jim Riker, Board chair of Citizens for Global Solutions, one of over 100 NGOs protesting the selection process, echoed the call for European leaders to stick by their earlier commitments. “Each time, European officials promise that the next time an opening arises a fully fair and democratic process will occur,” only to capitulate to extenuating circumstances he noted.

Lagarde has likely garnered enough support to coast to victory despite the transparent excuses and protestations from civil society and other governments. At this point, Brazil may demonstrate the most practical way forward (as I suggested here and here) out of the mess, by agreeing to support Lagarde, but “only until the end of next year, when Strauss-Kahn’s term would have expired.” This would give notice to the rest of the world to get their act together and unite behind a single candidate before it is time to choose the the next Managing Director.

2 thoughts on “Calling out the hypocrisy”